Which direction will the auto industry take?

If you follow auto sales, you know two things about how they’ve been doing recently. They boomed the past couple of years, but they’ve started to trail off this year.

That’s no surprise. The auto industry is a cyclical business. But, there’s a growing awareness that the automotive landscape is changing, and even people who produce cars for a living may not realize what is heading their way.

That’s a conclusion from a new report by AlixPartners, the strategic planning and consulting firm used by major companies worldwide. Some of AlixPartners’ experts were involved in advising the Obama Administration about the bailout of the auto industry, back in 2009, so it’s a prestigious name.

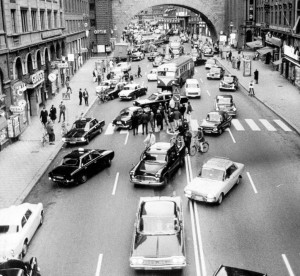

“There’s an all-new automotive ecosystem developing, and I fear that many players really aren’t prepared for it,” says John Hoffecker, global vice chairman at AlixPartners. “The changes coming are the biggest since the internal-combustion engine pushed aside horses and buggies.”

But, Hoffecker also says the changes are as unpredictable as “trying to guess which app is going to be most popular on next year’s smartphones.”

I spent some time reading the report this past week, and these things jumped out at me.

New ideas and competition

Five years ago, Tesla was a curiosity, a billionaire’s pet project promising to produce ultra-luxury electric cars. Now, Tesla is one of the most valuable brands in the automobile industry and it just built the first Model 3, the moderately priced electric car it wants to sell to the masses.

Tesla’s rise shows just how fast things are moving in the industry and the influence that an outsider can have. To give it some perspective, five years is the length of a car company’s production cycle, the number of years that a model is generally on the market before a major change.

AlixPartners says there are now 50 companies competing to produce autonomous vehicle systems. It’s a “wild west” atmosphere that the industry hasn’t seen in more than a century, when there were dozens of car companies in the U.S. and around the world.

There will likely be a handful of big winners, says the study, but on the other hand, also many disappointed investors. But because of the crazed competition, AlixPartners estimates that the price of automated-vehicle systems could drop by 78 percent by 2025. (That’s just one-and-a-half product cycles away.)

AlixPartners believes China will play a big role in electric vehicles. Of the 103 electric vehicles planned by 2020, 49 of them will come from Chinese manufacturers. Remember, we told you last week that Volvo is planning an all-hybrid and electric lineup, and Volvo is now owned by a Chinese company, Geely.

Interestingly, the report says that hybrid sales in the U.S. have slowed, from 3.2 percent of the market in 2013 to just 2.1 percent so far in 2017, while plug-in and electric vehicle sales are just one percent of the U.S. market. Still, with gas prices under $2.30 in most places, it’s easy to understand the lack of interest. Just wait and see what happens if gas prices spike.

Ride-hailing’s big impact

When I wrote the Curbing Cars ebook for FORBES in 2014, one of the companies that everyone was talking about was ZipCar. The car-sharing firm was revolutionizing how people thought about rental cars and car ownership. Universities, city governments and other institutions were lining up to replace their fleets with Zipcars, and consumers seem intrigued by the thought of renting a vehicle for an hour or two.

While ZipCar, Car2Go and others are still part of the landscape, car-sharing has been passed by ride-hailing, at least in consumers’ minds. According to an AlixPartners survey of 1,000 consumers in 10 key markets, 24 percent said they would use ride-hailing the same amount or more than in the past, versus only five percent who said they would use it less.

Among the respondents in those cities, the survey found that ride-hailing was five times more likely to be a top-three transportation mode than was car-sharing (11.6 percent vs. 2.5 percent, and three times more likely than traditional taxis (11.6 percent vs. 4.2 percent).

But in an interesting note, the survey found that the use of Uber, Lyft and the other apps is replacing cars that would have been driven 5,000 miles per year or more. That indicates urban residents, who might not drive much anyway, are using ride-hailing as a car substitute, not the suburbanites and rural residents on whom the car companies depend heavily for sales.

Two markets for automobiles

In 2009, auto industry sales plummeted to their worst levels since 1982, due to the deep recession, the car companies’ bankruptcies and consumers’ inability to get credit. Automakers sold just 10.4 million vehicles.

The industry has been on a steady climb since then, reaching 17.5 million in 2016, the seventh consecutive year of higher sales. Almost everyone, however, agrees that sales in 2017 will be lower, and might continue to fall.

AlixPartners is forecasting that sales will drop this year to 16.9 million, and 15.2 million in 2019. Compared with the levels last year, 15.2 million sounds kind of dire. But in fact, it’s what many analysts consider the “trend” or natural level for auto sales in the United States.

It’s pretty clear that two markets are developing for automakers. One is the traditional big-vehicle market, dominated by pickups and sport utility vehicles, or “cars by the pound,” as some people joke. The other will be an almost experimental market of electric vehicles, hybrid cars, self-driving vehicles and other innovations.

Because so many people in the American auto industry measure success by unit sales, there will be plenty of resistance to the idea that the second market is any kind of a threat to the first. But, it only takes a quick look abroad to see that others are taking it seriously.

Carmakers like Volvo and countries such as France are getting ready for what the second market will bring, in part because they aren’t really part of the first (Volvo of course sells SUVs, but it is far better known for cars).

This is a fascinating time for people who’ve watched the ups and downs of the auto industry. Whatever is going on now could be a turning point for an industry which is still fairly young, in historic terms.

Says Hoffecker at AlixPartners: “Leading players will be those that both study hard and are fast on their feet.”